Have you ever thought about what it’s like to be a Probationary Officer at India’s largest public sector bank? I’ll take you behind the scenes of one of banking’s most coveted jobs.

Having helped many aspirants chart out their bank career journey, I bring you, the unfiltered truth about SBI PO life, from your first paycheck to your corner office dreams!

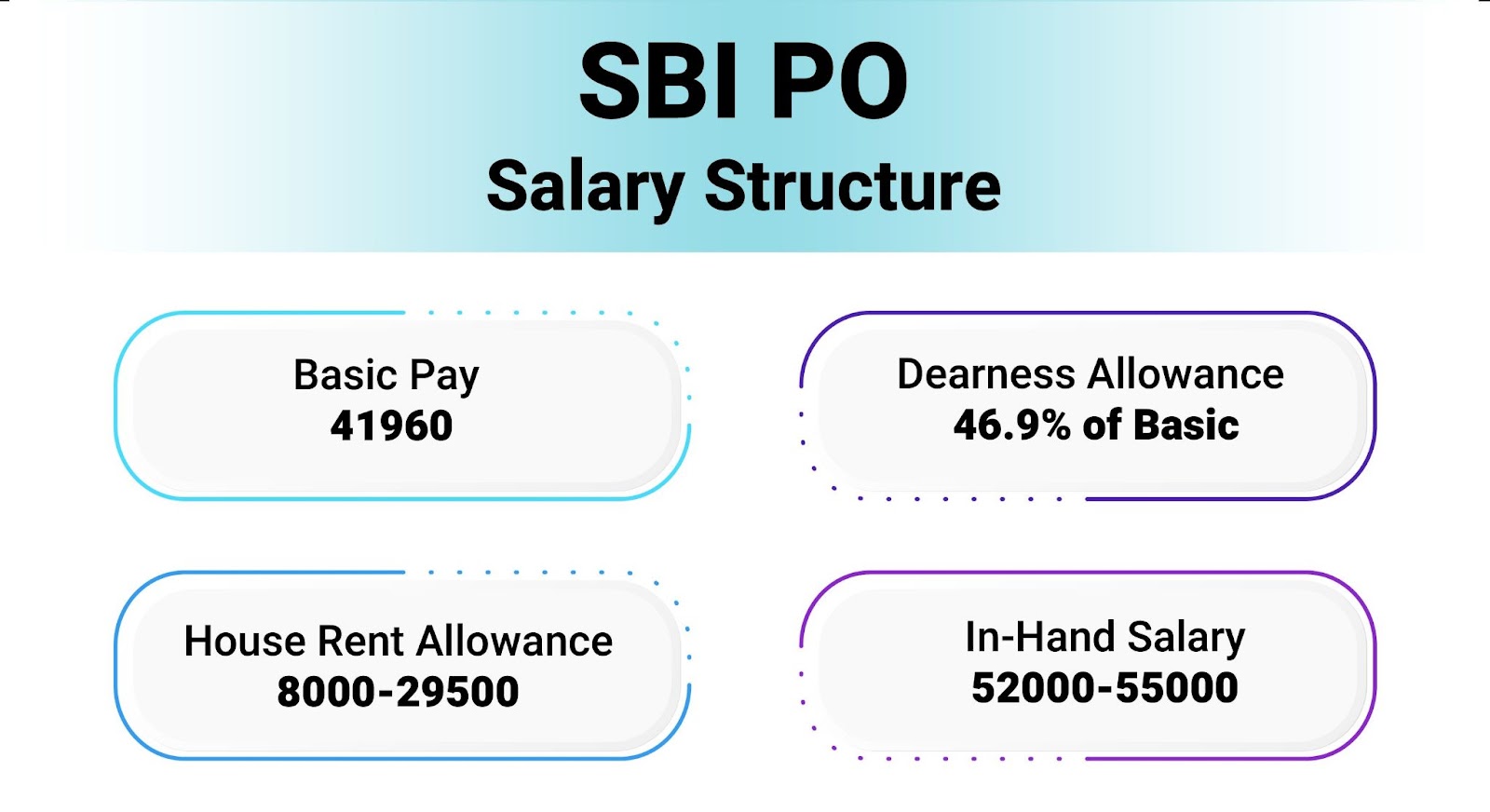

SBI PO Salary Breakdown

First things first, the elephant in the room – the SBI PO salary package! Here’s what you can expect as a fresh SBI PO in 2024:

Basic Salary Structure

- Basic Pay: ₹41,960/- (Starting scale)

- DA (Dearness Allowance): 46.9 percent of basic pay

- Furniture Allowance: ₹1,20,000/-

- City Compensatory Allowance (CCA): Based on posting location, 4 percent or 3 percent.

Additional Benefits

House Rent Allowance (HRA)

INR 8000 (in rural areas) and a maximum of INR 29, 500 (In Mumbai).

Perks and Allowances

- 100 percent of medical coverage for SBI employees and 75 percent for their family members

- Newspaper Allowance

- Entertainment Allowance

- Fuel Allowance

- Annual Leave Travel Concession (LTC)

- Festival Advance

In-Hand Salary

- Fresher SBI PO: Approximately ₹52,000 – ₹55,000.

- After deduction in PF, Income tax etc.

- It depends on where you post and what allowances apply.

The Life of an SBI PO: Job Profile Decoded

Initial Training Period

- 2-year probation period

- Training at SBI training centers

- Different banking operations exposure.

- On the job and in the classroom training

Key Responsibilities

Customer Service

- Account opening and account maintenance

- Tackling customers’ queries and complaints

- Banking product cross-selling

- Relationship management

Operations Management

- Cash management

- Transaction processing

- Branch operations supervision

- Compliance monitoring

Credit Management

- Documentations and loan processing.

- Credit appraisal

- Portfolio management

- Recovery monitoring

Team Leadership

- Staff supervision

- Performance monitoring

- Training junior staff

- Resource allocation

Department Rotations

As an SBI PO, you’ll get exposure to various departments:

- General Banking

- Advances

- Foreign Exchange

- Credit Card Division

- Treasury Operations

- Risk Management

- Marketing Division

Career Growth Trajectory

SBI PO stands out among other banking jobs due to its appealing career growth trajectory.

Short-Term Growth (0-5 years)

- Assistant Manager to Probationary Officer

- Branch banking experience

- Specialization development

- Leadership skill development

Mid-Term Growth (5-10 years)

- Manager to Senior Manager

- Responsibilities of the department head

- Specialized role options

- Branch manager opportunities

Long-Term Growth (10+ years)

- Chief Manager and above

- Regional office positions

- Opportunities in the corporate office

- Leadership of specialized divisions

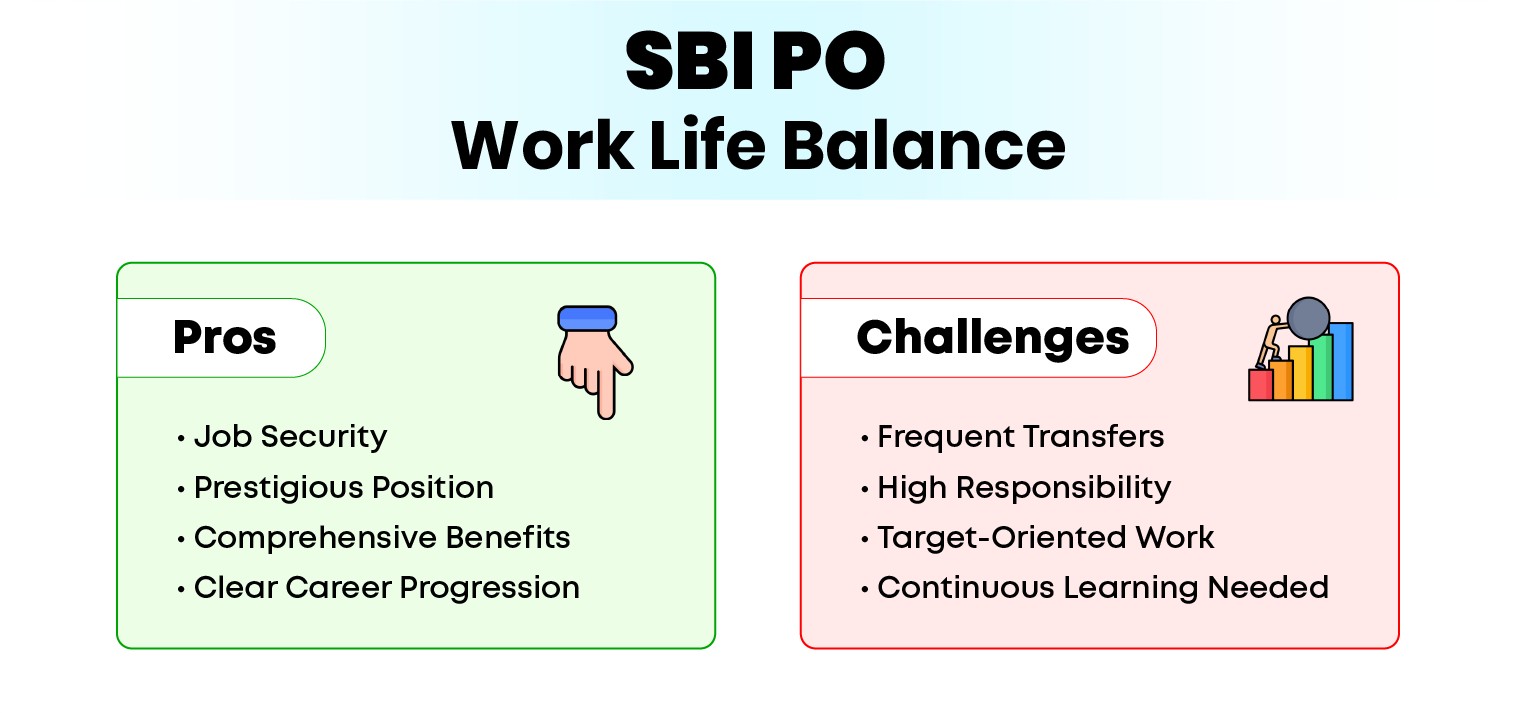

Work-Life Balance and Job Satisfaction.

Pros

- Job security

- Prestigious position

- Benefits package.

- Clear career progression path

- Learning opportunities

- Wide network exposure

Challenges

- Early years can be difficult

- Frequent transfers

- High responsibility levels

- Work environment targeted

- Need for continuous learning

Tips for Success as an SBI PO

First Year Success

- Learn core banking operations

- Develop a relationship with colleagues.

- Know the bank’s systems and procedures.

- Learn customer service skill

Career Development

- Banking sector news for you to stay updated

- Get additional certifications

- Build a strong network

- Develop leadership skills

- Learn from senior officers

Work-Life Integration

- Learn how to manage your time

- Create efficient work systems

- Build support networks

- Plan transfers strategically

- Maintain health and wellness

Future Prospects

The role of SBI PO is evolving with:

- Digital banking transformation

- Fintech integration

- New-age banking products

- Customer-centric approach

- Analytics-driven decisions

Conclusion

SBI PO doesn’t just mean a job, not anymore. It’s an opportunity to become a part of India’s financial evolution and be a part of something big with an open-ended career path.

Of course, it might be challenging initially but working with an attractive salary, lots of benefits, and a clear growth path make it one of the most sought-after careers in the banking sector.

However, don’t forget to realize that the SBI PO designation and the salary they pay aren’t the only things defining success for an SBI PO; success for an SBI PO is to impact a huge banking ecosystem and the lives of thousands of customers.

Whether it’s for the SBI PO Exam or you’re fresh into the job as a Probationary Officer, this thorough understanding of the role will aid you in making informed decisions and shaping your future better.

For more central govt. job updates, check here.